CA EDD DE 2251A 2013-2026 free printable template

Show details

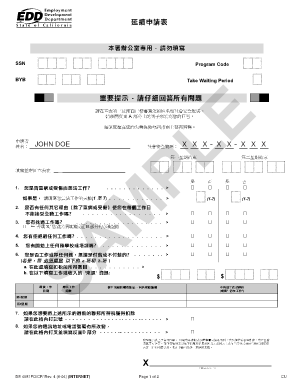

2 For calendar years beginning January 1, 2011, and after. P.O. Box 826805 Sacramento CA 94205-0001. DE 2251A Rev. 22 (2-13) (INTERNET). Page 1 of 2.

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign what is the edd affidavit information from the unemployed individual

Edit your affidavit of wages form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your of wages edd how to fill out affidavit of wages edd form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing affidavit edd online

Use the instructions below to start using our professional PDF editor:

1

Log in to account. Start Free Trial and register a profile if you don't have one yet.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit step 3 is to write such as meals and lodging form. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

It's easier to work with documents with pdfFiller than you could have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form edd affidavit

How to fill out CA EDD DE 2251A

01

Obtain the CA EDD DE 2251A form from the California Employment Development Department's website or your local office.

02

Fill in your personal information at the top of the form, including your name, Social Security number, and mailing address.

03

Indicate the reason for your claim by providing specific details regarding the period for which you are filing.

04

If applicable, provide information related to your employment history, including the name of your employer and your job title.

05

Review the instructions on the form carefully to ensure that all required information is provided accurately.

06

Sign and date the form to certify that the information you have provided is true and correct.

07

Submit the completed form to the appropriate EDD office as instructed on the form.

Who needs CA EDD DE 2251A?

01

Individuals who are applying for unemployment insurance benefits in California.

02

Workers who have been laid off, had their hours reduced, or are otherwise eligible for unemployment assistance.

03

Previously self-employed individuals who are seeking unemployment benefits due to a loss of income.

Fill

affidavit wages file

: Try Risk Free

People Also Ask about edd affidavit wages

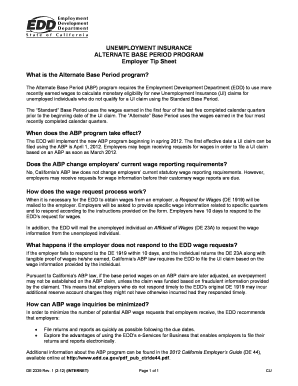

What is the EDD form DE 4581?

Describes the different types of UI fraud and how to report it to EDD. An insert periodically mailed with the Continued Claim Form (DE 4581) to remind claimants to report work and wages when collecting Unemployment Insurance benefits.

How do I file DE 4581 online?

How to edit de 4581 online Log in to account. Click on Start Free Trial and register a profile if you don't have one. Upload a document. Edit de4581 form. Get your file.

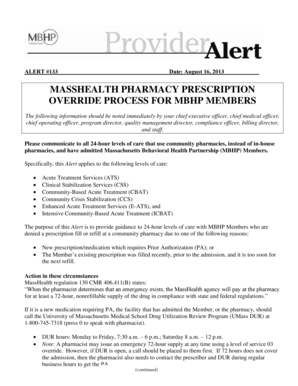

What happens if you don't have proof of income for EDD?

Penalties. If you don't submit the required documentation that proves you were employed, self-employed, or planning to be employed or self-employed during the calendar year before and up to the start of your claim, you may have to repay any benefits determined to be an overpayment.

How do I send proof of income to EDD?

Submit Your Documents Recommended: Log in to your UI Online account and go to the Upload Income Documents for PUA section on the homepage to provide the required documents. If you prefer to mail your documents, write your 10-digit EDD Customer Account Number (EDDCAN) clearly at the top of each page.

How do I write an affidavit for EDD?

1:36 6:15 CA EDD: How To Write An Affidavit For PUA Unemployment - YouTube YouTube Start of suggested clip End of suggested clip For example my name is shelley's millions i'm 44. And reside at 1122 future millionaires lane losMoreFor example my name is shelley's millions i'm 44. And reside at 1122 future millionaires lane los angeles california 9002 8. Step 3 is to write a statement of truth.

What happens if you don't report wages to EDD?

Once you are eligible and receiving benefit payments, you must report any income you received, or that you have returned to work. If you don't, it could result in an overpayment, penalties, and a false statement disqualification.

How do I provide proof of income with EDD?

Tax documents such as the IRS 1040 and an associated Schedule C are preferred. For regular employment, the documents must show your gross income (total paid before taxes and payroll deductions), such as a W-2. Providing check stubs showing your earnings each quarter would also be helpful.

What is the EDD Affidavit of wages?

In addition to mailing the employer a DE 1919, the EDD will mail the unemployed individual an Affidavit of Wages (DE 23A) to request the wage information from the unemployed individual.

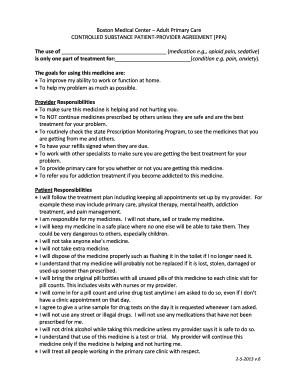

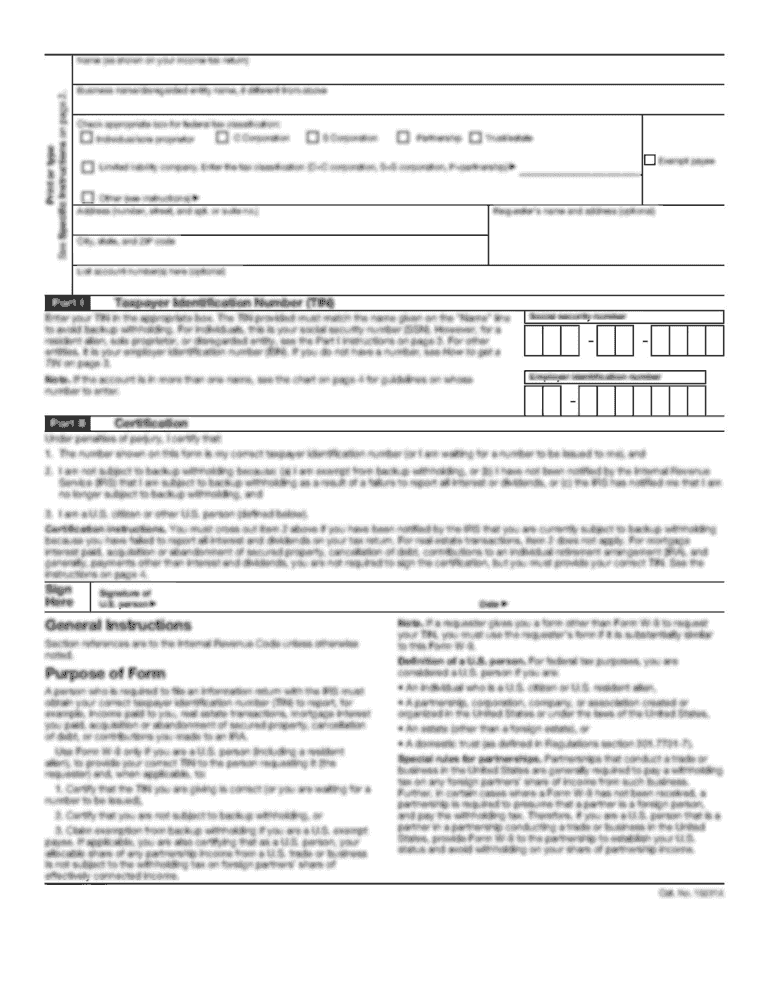

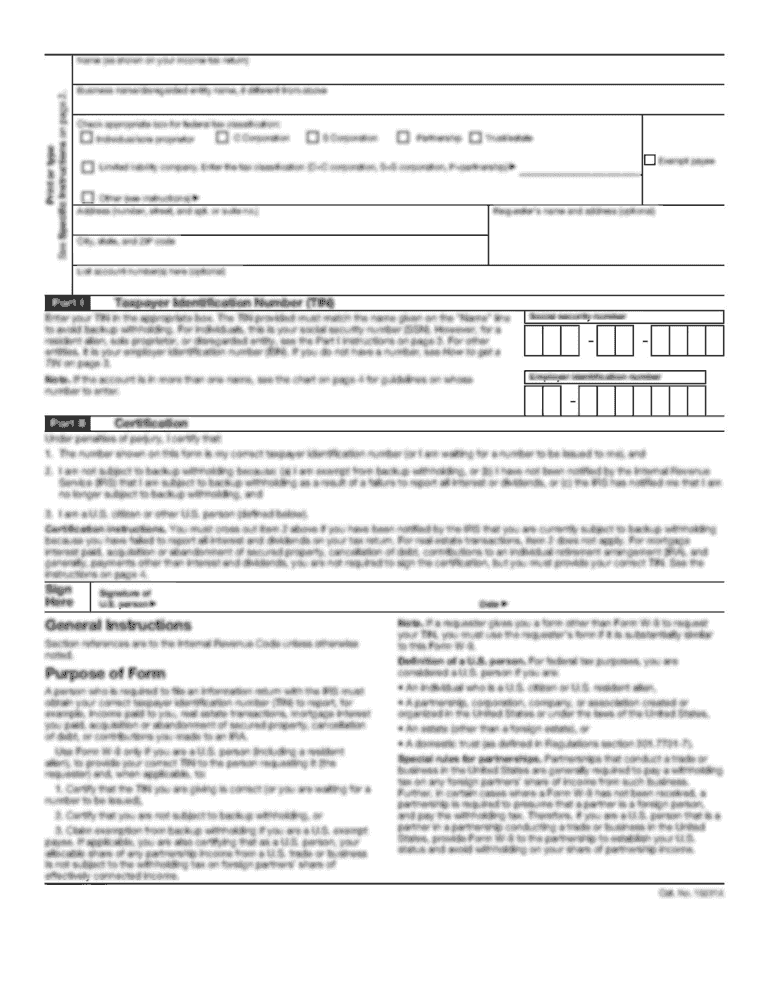

What is the EDD definition of wages?

Wages are compensation for an employee's personal services, whether paid by check or cash, or the fair cash value of noncash payments such as meals and lodging.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify de 2251a without leaving Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including affidavit of wages paid. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

How can I send california edd to be eSigned by others?

Once your de 2320 is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

How do I fill out the de 1919 form on my smartphone?

Use the pdfFiller mobile app to complete and sign edd address mailing on your mobile device. Visit our web page (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, the capabilities you’ll have access to, and the steps to take to get up and running.

What is CA EDD DE 2251A?

CA EDD DE 2251A is a form used by the California Employment Development Department for reporting payroll information related to unemployment insurance benefits.

Who is required to file CA EDD DE 2251A?

Employers in California who have employees and pay unemployment insurance taxes are required to file CA EDD DE 2251A.

How to fill out CA EDD DE 2251A?

To fill out CA EDD DE 2251A, complete the required fields with accurate payroll information, including the number of employees, total wages paid, and unemployment insurance tax contributions.

What is the purpose of CA EDD DE 2251A?

The purpose of CA EDD DE 2251A is to provide the state with necessary payroll and tax information to ensure compliance with unemployment insurance regulations.

What information must be reported on CA EDD DE 2251A?

Information that must be reported on CA EDD DE 2251A includes employer details, employee payroll data, total wages for the reporting period, and the amount of unemployment insurance taxes paid.

Fill out your CA EDD DE 2251A online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Payroll Affidavit is not the form you're looking for?Search for another form here.

Keywords relevant to alternate base period

Related to sdis commission de s

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.